taxes en estados unidos 2020

Code 34-1-6 1999 2020 requires employers to provide break time of reasonable duration to an employee who desires to express breast milk at the worksite during work hours this break time shall be paid at the employees regular rate of compensation. Mínimo de ingresos para patrocinar la green card a un familiar en 2020.

6 Differences Between Vat And Us Sales Tax

By some estimates China will overtake the US in RD spending in 2020.

. Se pueda ingresar ese dinero en Estados Unidos. In the United States Social Security is the commonly used term for the federal Old-Age Survivors and Disability Insurance OASDI program and is administered by the Social Security Administration. There have been 23 federal censuses since that time.

The most recent national census took place in 2020. Rocket Lawyer makes the law affordable and simple. 40 2022 1206 million.

Anteriormente el IRS usaba el Índice de Precios al Consumidor IPC para hacerlo pero ahora -en cumplimiento con la Ley de Empleos y Reducción de Impuestos del año 2017- utiliza el Índice de Precios al. Below is a table of the amount of exemption by year an estate would expect. In what is sometimes called the Revolution of 1800 Vice President Thomas Jefferson of the Democratic-Republican Party defeated incumbent President John Adams of the Federalist PartyThe election was a political realignment that.

And a regular Statement and Account of Receipts and Expenditures of all public Money shall be published from time to time. Earn your wilderness badge as you cruise. He had paid no income taxes at all in 10 of the.

Algunos países no permiten el envío de divisas al. Constitution and takes place every 10 yearsThe first census after the American Revolution was taken in 1790 under Secretary of State Thomas Jefferson. My employer allowed me to take time off but did not pay me for my last two weeks of FFCRA leave.

Constitution Article I section 9 clause 7 states that No money shall be drawn from the Treasury but in Consequence of Appropriations made by Law. Alejandra Ramos CNN Estados Unidos participará en un ejercicio militar conjunto con India a menos de 100 kilómetros 62 millas de la disputada frontera del país del sur de Asia con China. The 1800 United States presidential election was the fourth quadrennial presidential electionIt was held from October 31 to December 3 1800.

A continuación veremos una tabla de taxes para que sepas cuánto deberás abonar en 2022 por el año fiscal 2021 de Estados Unidos. The United States census plural censuses or census is a census that is legally mandated by the US. 2020 1158 million 40 2021 117 million.

Cities are creatively tackling this problem including by implementing energy taxes that reduce emissions Boulder CO electrifying public transit eg Los Angeles and pledging all municipal electricity be generated by carbon-free sources by 2020 eg Kansas City MO. For more information see IRSgovCOVID-19-Related-Tax-Credits. Michael Richard Pence Columbus Indiana 7 de junio de 1959 es un político y abogado estadounidense que ejerció como 48º vicepresidente de los Estados Unidos desde 2017 hasta 2021.

9 de diciembre de 1953 conocido como John Malkovich es un actor productor director de cine y diseñador de modas estadounidenseHa trabajado como actor en más de setenta películas entre ellas El imperio del sol The Killing Fields Con Air Of Mice and Men Being John Malkovich Burn After Reading RED y Warm Bodies y ha. 40 As noted above a certain amount of each estate is exempted from taxation by the law. La guerra industrial comercial entre China y los Estados Unidos es un conflicto comercial iniciado en marzo de 2018 después de que el expresidente de los Estados Unidos Donald Trump anunciase la intención de imponer aranceles de 50 000 millones de dólares a los productos chinos bajo el artículo 301 de la Ley de Comercio de 1974 argumentando un historial de.

John Gavin Malkovich Christopher Illinois. Fue el 50º gobernador de Indiana de 2013 a 2017 2 y sirvió seis mandatos en la Cámara de Representantes de Estados Unidos de 2001 a 2013. Each year the President of the United States submits a budget request to.

Extension and expansion of credits for sick and family leave. And as part of Chinas Made in China 2025 plan Chinas government has launched funds to increase manufacturing and technological. THE MOST EXCITING CRUISE DESTINATIONS AND AWARD-WINNING SHIPS Unlock some of the most incredible travel destinationsGet on island time and unwind on some of the best beaches in the world venture deep into the rainforests and snorkel the most vibrant reefs on a Caribbean or Bahamas cruise getaway with the whole family.

Create and sign legal documents online get legal advice from attorneys incorporate your business and more. Pence nació y se crio en Columbus. I used 6 weeks of FFCRA leave between April 1 2020 and December 31 2020 because my childcare provider was unavailable due to COVID-19.

In his first year in the White House he paid another 750. De Lunes a Viernes. The days of taxpayer benefits going to companies that seek to outsource jobs or avoid paying their fair share of taxes are over.

Alcohol and Tobacco Tax and Trade Bureau TTB Bureau of Engraving Printing BEP Financial Crimes Enforcement Network FinCEN Bureau of the Fiscal Service BFS. The COVID-related Tax Relief Act of 2020 extended the period during which self-employed individuals can claim these credits from April 1 2020 through March 31 2021. Información videos y fotos sobre los hechos más relevantes y sus protagonistas.

Noticias de Argentina y del mundo en tiempo real. Trump paid 750 in federal income taxes the year he won the presidency. We survey more than 200 private equity PE managers from firms with 19 trillion of assets under management AUM about their portfolio performance decision-making and activities during the Covid-19 pandemic.

Airport Arrival Lounge in Jamaica and Saint Lucia Available in Select Rooms. Estos son los mínimos que aplican desde 15 de enero de 2020 Ingresos para NO militares para patrocinar a un familiar. Léelo antes en infobae.

Taxes which apply to estates or to inheritance in the United States trace back to the 18th century. Employers are also required to provide a private location other than a restroom for. All Taxes Tips and Gratuities.

The original Social Security Act was enacted in 1935 and the current version of the Act as amended encompasses several social welfare and social insurance programs. Resto estados y PR. Is my employer required to pay me for my last two weeks if the FFCRA has expired.

Find The Best Legal Sports Betting Sites For 2020 Learn Where To Bet On Sports Legally The Current Status Of Online Sports Betting Show Me The Money Betting

How Your Tax Refund Can Move You Toward Homeownership This Year Tax Refund Home Ownership Real Estate Buyers

Trump S Taxes Show Chronic Losses And Years Of Income Tax Avoidance The New York Times

Pin En Taxes En Estados Unidos

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

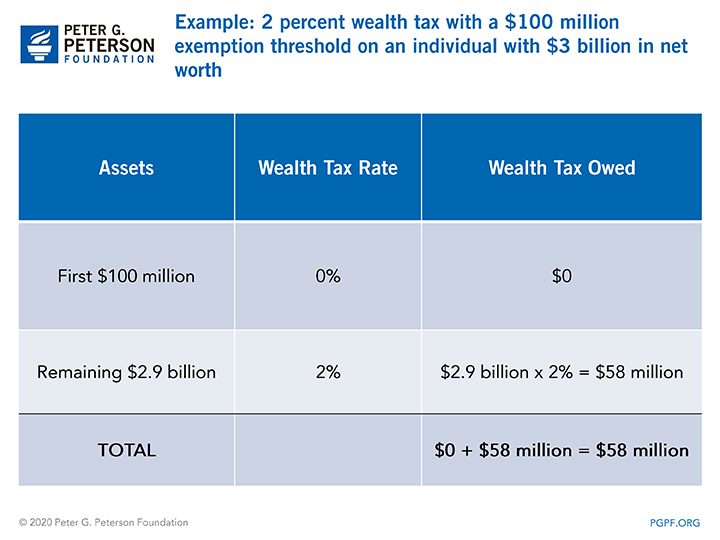

What Is A Wealth Tax And Should The United States Have One

50 Deducciones En Los Impuestos Que Mas Te Ahorran Dinero En El 2021 Ahorrar Dinero Impuesto Estados Financieros

Documentos Que Necesitas Para Hacer Los Taxes Paz Financiera Marketing En Espanol Finanzas Personales

Irs Income Tax Youtube Hola Chiquita Instagram

How Progressive Is The Us Tax System Tax Foundation

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

How To Fill Out Irs Form 1040 What Is Irs Form 1040 Es

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

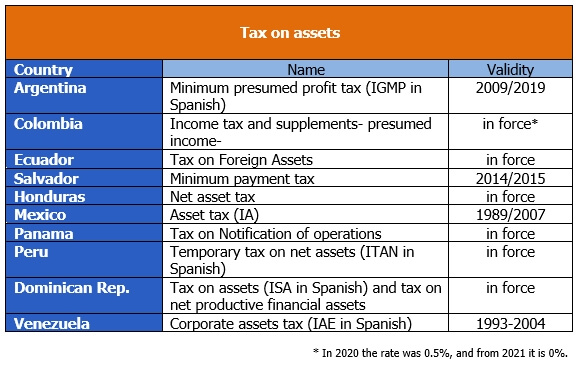

Income Tax Minimum Tax Inter American Center Of Tax Administrations

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Pin En Taxes En Estados Unidos

Taxes 2020 These Are The States With The Highest And Lowest Taxes

Cuanto Dinero Recibire Del Estimulo Economico En Estados Unidos Youtube Estados Unidos Economico Dinero