kentucky lottery tax calculator

The table below shows the payout schedule for a jackpot of 135000000 for a ticket purchased in Kentucky including taxes withheld. Probably much less than you think.

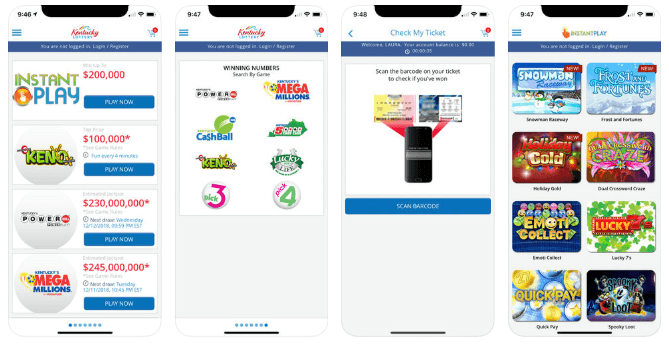

Kentucky Lottery Ky Results Winning Numbers Fun Facts

Lottery tax calculator takes 6.

. Lottery Calculator provides Federal and statelocal taxes and payout after. 25 State Tax. Please note the amounts shown are.

The exact amount depends on the rules of the actual game. These lottery tools are here to help you make better decisions. Filing 4000000 of earnings will result in 306000 being taxed for FICA purposes.

The latest changes to the lottery law imply that you will have to. By law Kentucky lottery will withhold 24 of winnings for federal taxes and 50 for state income taxes. You must report that money as income on your 2019 tax return.

- Kentucky State Tax. That may not sound like a lot but it adds up very quickly. Lottery tax rate is 65.

Calculate your lottery lump sum or. Heres a breakdown of how. Kentucky Cigarette Tax.

A lottery payout calculator can also calculate how much tax youll pay on your lottery winnings using current tax laws in each state. Buy a Lottery ticket now. For one thing you can use our odds calculator to find the lotteries with the best chances of winning.

In 2018 Kentucky legislators raised the cigarette tax by 50 cents bringing it up to 110 per pack of 20. A federal tax of 24 percent will be taken from all prizes above 5000 including the jackpot before you receive your prize money. Aside from state and federal taxes many Kentucky.

Lottery Calculator provides Federal and statelocal taxes and payout after Powerball Mega Millions winning. Just enter the five-digit zip. This can range from 24 to 37 of your winnings.

Lottery tax calculator takes 0 percent since there is no lottery in the state. Recently the Mega Millions hit a whopping 1 billion. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Kentucky Tax on Lottery Winnings. You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202122. Using the lottery annuity payout calculator you can see the estimated value of the different payout installments for each year.

5 Louisiana state tax on lottery. Burkart stopped at Harlan Food Mart on. Income tax withheld by the US government including income from lottery prize money.

Lottery tax calculator takes 765 on 2000 or more. Gambling winnings are typically subject to a flat 24 tax. Filing 4000000 of earnings will result in 186150 of your earnings being taxed as.

Kentucky imposes a flat income tax of 5. If you held the winning ticket for that drawing you would have paid 60 million right off the top to the state of Kentucky alone. For example lets say you elected to receive your lottery winnings in the form of annuity payments and received 50000 in 2019.

However for the activities listed below winnings over 5000 will be subject to income tax withholding. The money you spend on each and every Kentucky Lottery game you play goes many different places including to the funding of Kentucky college scholarships. Kentucky has a 6 statewide sales tax rate but also.

The statistics indicate that India has one of the harshest taxes in the world. And you must report the entire amount you receive each year on your tax return. 5 Kentucky state tax on lottery winnings in USA.

So while the actual number of millions you will be given changes depending on the size of your prize and any applicable taxes a lottery annuity calculator can help you estimate. Our calculator has recently been updated to include both the latest Federal Tax. Lottery taxes are anything but simple the exact amount you have to pay depends on the size of the jackpot.

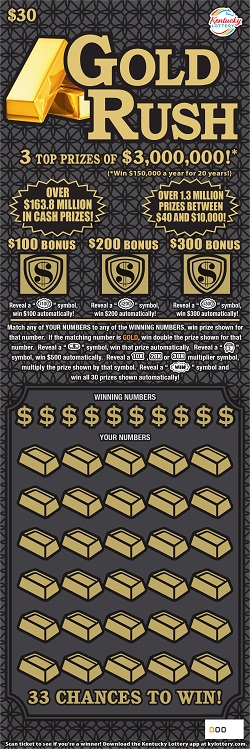

You may then be eligible for a refund or have to pay more. The tax rate is the same no matter what filing status you use. Philip Burkhart of Harlan KY says he is blessed after he won 100000 on a Kentucky Lottery Scratch-Off ticket.

Kentucky imposes a 6 percent tax rate on all lottery winnings. The Lottery Tax Calculator- calculates the tax lump sum annuity payment after lotto or lottery winnings. This tool helps you calculate the exact amount.

Wed May 04 122700 EDT 2022. This is still below the national average. Overview of Kentucky Taxes.

Lottery Winning Taxes for India. That means your winnings are taxed the same as your wages or salary.

Lottery Tax Calculator How Your Winnings Are Taxed Taxact Blog

![]()

Best Lottery Tax Calculator Lotto Lump Sum Annuity Payout

Kentucky Lottery Ky Results Winning Numbers Fun Facts

Best Lottery Tax Calculator Lotto Lump Sum Annuity Payout

Usa Lottery Tax Calculators Comparethelotto Com

Best Lottery Tax Calculator Lotto Lump Sum Annuity Payout

Lottery Tax Calculator Updated 2022 Lottery N Go

Pick 4 Kentucky Ky Latest Lottery Results Game Details

Lottery Tax Calculator How Your Winnings Are Taxed Taxact Blog

Taxes On Lottery Winnings In Kentucky Sapling

![]()

Kentucky Man Arrested Days After Winning 250 000 Lottery Prize Lottery Post